Questions?

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Visit NCR.com/Silver

Browse by categories

Working with Tax Jurisdictions

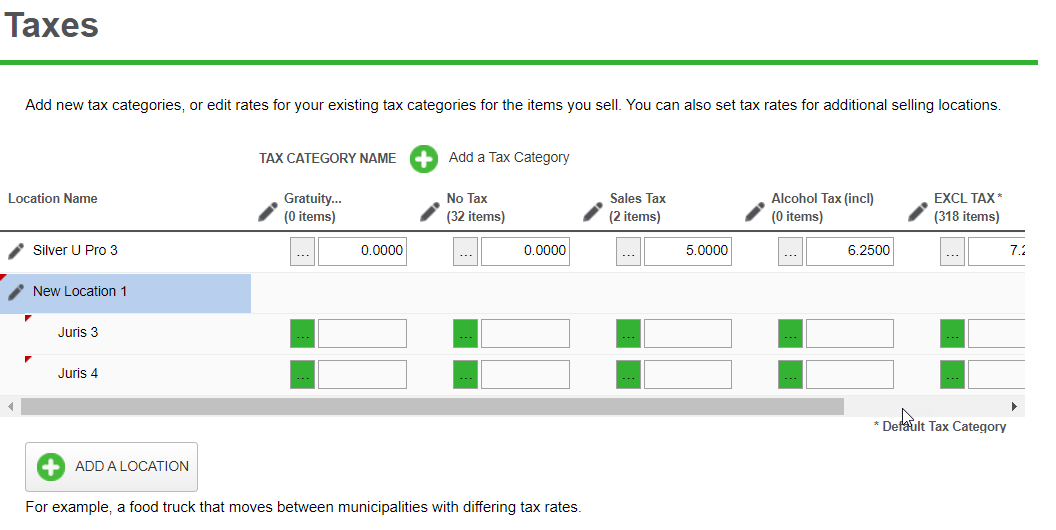

In some locations, it is necessary to track the collection of sales tax according to tax jurisdiction and to display the sales tax assessed by tax jurisdiction on the customer receipt. Your Back Office enables you to easily configure your tax settings to comply with your tax jurisdiction regulations.

In some locations, it is necessary to track the collection of sales tax according to tax jurisdiction and to display the sales tax assessed by tax jurisdiction on the customer receipt. Your Back Office enables you to easily configure your tax settings to comply with your tax jurisdiction regulations.

- Select Settings > Taxes.

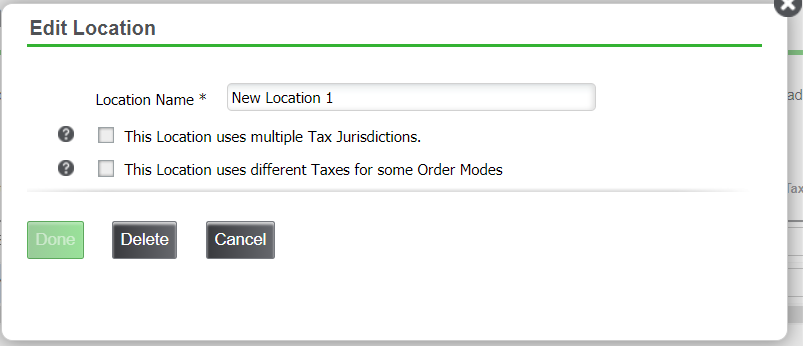

- Click a location from the Location Name column. The Edit Location screen appears.

- Select This location uses multiple Tax Jurisdictions. The Edit Location screen expands to include Tax Jurisdictions.

- Type the name of each jurisdiction in the fields provided.

- Click Done. The system returns to the Taxes screen.

- For each tax jurisdiction, enter the tax percentage or select the tax table for each category.

- Click Save and exit the Taxes screen.